Finance Your $11,000 Startup Cost — Interest-Free

Use a 0% loans to fund equipment, inventory, or your Blink Fuel setup with no interest for 12–24 months.

Charge the purchase directly (if the card offers 0% on purchases) or transfer a balance. Pay no interest during the intro period if you pay on time and clear the balance before it ends.

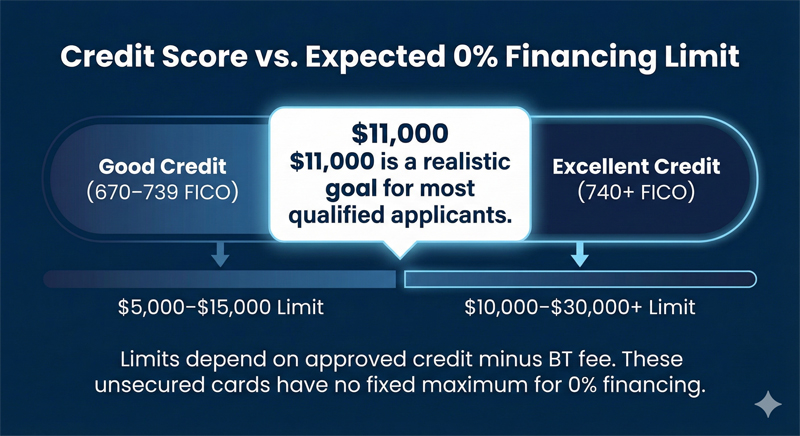

Credit limits vary by approval: $10K–$30K+ with excellent credit, $5K–$15K with good credit.

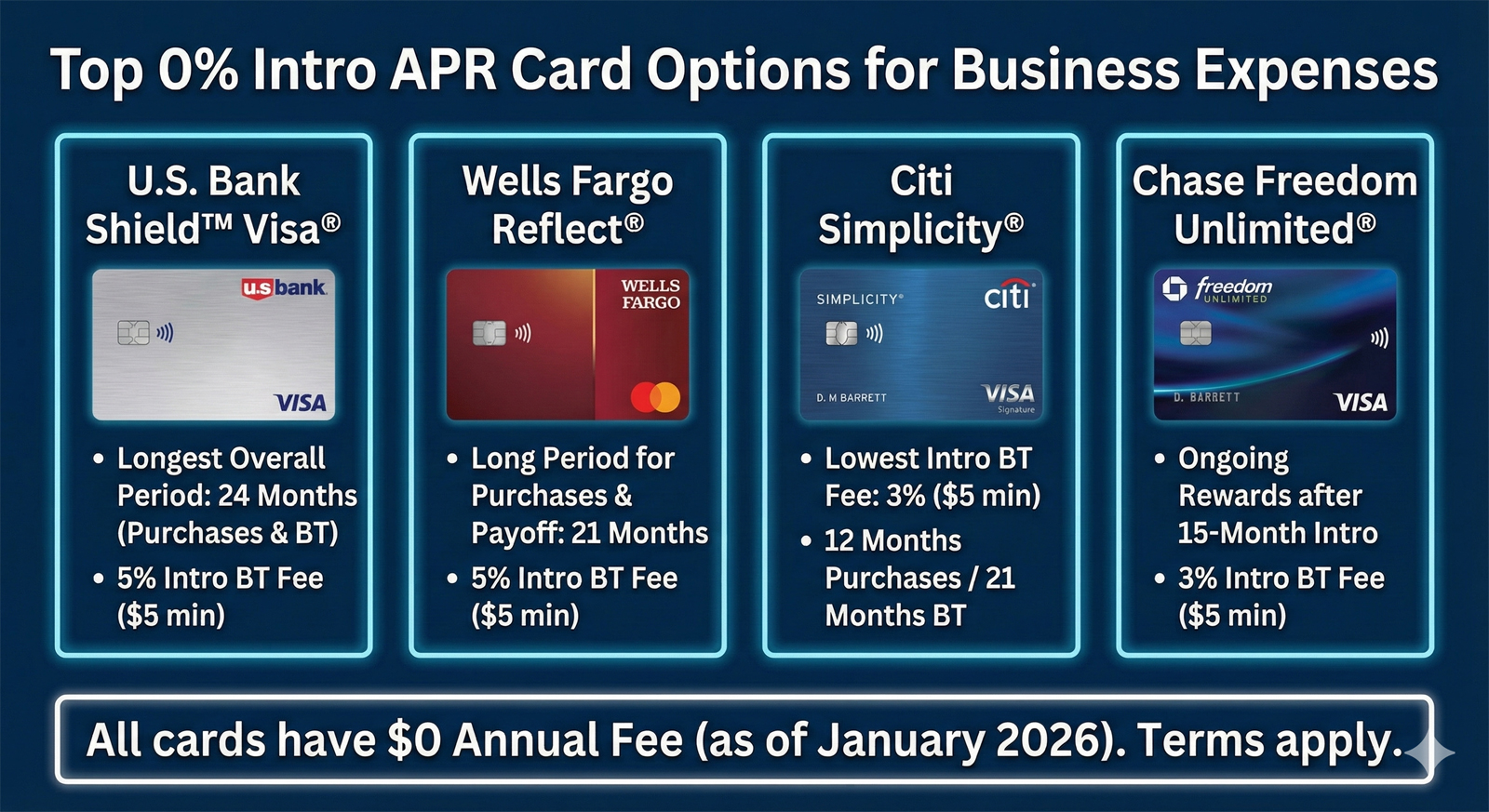

| Card Name | 0% Intro Period (Purchases / Balance Transfer) |

Intro BT Fee | Best For | Max 0% Financing Amount |

|---|---|---|---|---|

|

U.S. Bank Shield™ Visa® usbank.com 800-285-8585 |

24 months / 24 months | 5% ($5 min) | Longest overall interest-free period | Up to approved limit minus fee ($10K–$30K+ w/ excellent credit) |

|

Wells Fargo Reflect® wellsfargo.com 1-800-642-4720 |

21 months / 21 months | 5% ($5 min) | Long period for purchases & debt payoff | Up to approved limit minus fee ($10K–$30K+ w/ excellent credit) |

|

Citi Simplicity® citi.com 1-800-950-5114 |

12 months / 21 months | 3% intro ($5 min) | Lowest balance transfer fee | Up to approved limit minus fee ($10K–$30K+ w/ excellent credit) |

|

Citi® Diamond Preferred® citi.com 1-800-823-4086 |

12 months / 21 months | 5% ($5 min) | Long BT period with added perks | Up to approved limit minus fee ($10K–$30K+ w/ excellent credit) |

|

BankAmericard® bankofamerica.com 800-732-9194 |

18 months / 18 months | 3% intro | Solid intro rate & lower long-term APR | Up to approved limit minus fee ($10K–$30K+ w/ excellent credit) |

|

Chase Freedom Unlimited® creditcards.chase.com 1-800-935-9935 |

15 months / 15 months | 3% ($5 min) | Ongoing cash-back rewards | Up to approved limit minus fee ($10K–$30K+ w/ excellent credit) |

Pro Tip

For a new $11,000 expense, prioritize cards with long 0% on purchases (e.g., U.S. Bank or Wells Fargo). Pay minimums on time and aim to clear the balance before the intro ends to avoid high regular rates. This is a smart, low-cost way to bridge cash flow as your business grows.